There are a lot of different Forex brokers in Kenya, and it can be tough to know which one is right for you. HotForex is one of the forex brokers with a very heavy presence in Kenya. However, is the forex broker a good one? In this HotForex review, we will take a look at this broker’s features and see how they compare to other options on the market.

We will give you a complete review of HotForex, to help you decide if it is the right broker for you. We will cover everything from its trading platform to its customer service to its trading fees and instruments, so that you can make an informed decision about whether or not to sign up with them. Plus, we’ll show you how to get a $100 bonus just for signing up! Read on to learn more. So, let’s get started!

HotForex Kenya - An Overview

HotForex Kenya is a part of the HF Markets Group, which is a holding company that owns a number of regulated forex broker subsidiaries, including HotForex.

The HF Markets Group was founded in 2010 by a group of like-minded traders and entrepreneurs striving to provide excellent customer service and a first-class trading experience. The company started off with just the one goal in mind: to make Forex trading more accessible, cheaper, and user-friendly.

Since its inception, HotForex has continuously strived to provide top-tier trading conditions, education, and support to its clients. Today, the company is one of the world’s leading Forex brokers, offering its clients access to over 50+ currency pairs, precious metals, CFDs, and indices.

Todate, HF Markets Group has grown into one of the largest online brokers in the world. The company now employs over 1,000 people and services customers in more than 180 countries.

Because HotForex are regulated by varies authorities in different jurisdictions, traders can rest assured knowing their funds are safe and secure.

Is HotForex Regulated in Kenya?

Yes. HotForex is a regulated forex broker. The forex broker is regulated by the Capital Markets Authority in Kenya with license number 155.

The broker also has licenses from multiple regulatory bodies including the UK’s Financial Conduct Authority (FCA), the Cyprus Securities and Exchange Commission (CySEC) and the South Africa Financial Sector Conduct Authority (FSCA). This means that HotForex is held to high standards of conduct and financial reporting, and is regularly audited by these authorities.

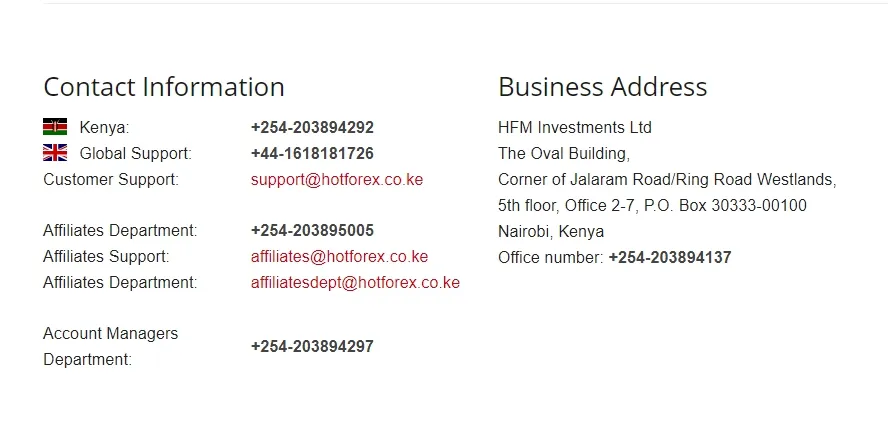

HotForex Customer Support Review

When looking for a forex broker, it is important to find one with good customer support. This will ensure that you have someone to help you if something goes wrong when trading.

The HotForex Kenya customer support is simply excellent. I’ve contacted them a few times and have always received prompt, helpful, and polite service. They are very knowledgeable about the products and services they offer, and they always work to resolve any issue as quickly as possible. I highly recommend them for anyone looking for quality customer service.

HotForex provides a number of customer support channels, which include online chat, telephone, and email. Telephone support is available 24/5.

HotForex Kenya Account Types

There are a 4 different types of forex trading accounts that you can open at HotForex Kenya. Each account type has its own benefits and drawbacks, so it’s important to choose the right one for your needs.

- HotForex Micro Account: The HotForex Micro Account is an account that allows you to trade in micro lots. (A micro lot is 1/100th of a standard lot, or $0.10 per pip when trading with USD-denominated currency pairs.) The HotForex Micro Account is perfect for beginner forex traders who want to learn how to trade forex, because it allows you to trade with a much lower initial investment (minimum deposit of $5). It’s also ideal for experienced traders who want to test out new trading strategies without risking too much money.

- HotForex Premium Account: The HotForex Premium account shares a lot of similarities with the Micro Account. In fact, the most notable differences are the minimum deposit, which is $100 for the premium account, the maximum number of simultaneously open orders (150 vs 300), and the maximum trade size (7 vs 30 lots).

- HotForex Zero Spread Account: The HotForex Zero Spread account is a commission-based account that allows traders to trade with spreads as low as 0 pips. The minimum deposit for this account type is $200 and the commissions start at $6 per lot for major currency pairs. The primary benefit of using a zero spread account is that it allows traders to enjoy tighter spreads and improved pricing. This can be advantageous when trading Forex, as it can help traders to maximize their profits by getting closer to the market prices.

- HFCopy Account: This is a copy trading account that has a minimum deposit of $300 for strategy providers and $100 for a follower. When you open a HFCopy account, you are automatically given the option to copy the trades of other traders. This is a great way to learn from the experience of more experienced traders, and to benefit from their successful strategies. However, it is important to note that copy trading carries its own risks, and you should always do your own research before investing.

There are a few key similarities between all forex account types at HotForex Kenya. The first is that all clients have access to the same range of trading platforms. This includes the MetaTrader 4 and 5 platforms.

The second similarity is that all accounts have access to customer support 24 hours a day, 5 days a week. The third similarity is that all accounts can trade a minimum lot size of 0.01. All HotForex account typs have leverage up to 400:1, as stipulated by the Capital Markets Authority.

And lastly, all of HotForex account types also come with access to their full range of more than 1200 tradeable products, so you can trade everything from currencies to commodities and indices.

HotForex Minimum Deposit

As with any forex broker, HotForex has certain minimum deposit requirements in order to open an account. The minimum deposit for a Micro account is $5, and the minimum deposit for a Premium account is $100. The Zero Spread has a minimum deposit of $200 while the HFCopy requires a minimum deposit of $100.

Keep in mind that these are merely the minimums - you can deposit more if you wish. And we actually recommend you deposit at least $250 if you really want to get an edge in your trading.

It’s also worth noting that HotForex offers a number of different funding options, including credit/debit cards, bank wire transfer, and third-party processors like PayPal, Mpesa and Skrill. So no matter what your preferred method of payment may be, you should be able to fund your account without any trouble.

The HotForex Mpesa option is the most preferable for traders in Kenya.

HotForex Mpesa Funding

HotForex has teamed up with Mpesa to bring you a quick, easy, and secure way to Deposit and Withdraw your funds. You can now use your Mpesa account to Deposit funds into your HotForex Trading Account, and also to withdraw your profits and/or margin.

To get started, simply sign into your MyHf client areas on HotForex and click on the “Deposit” tab. You will then see a list of all the available payment methods. Just select Mpesa from the list and follow the instructions on the screen.

At the last stage, you’ll get a prompt on your phone to input your Mpesa pin.

HotForex Tradeable Instruments

HotForex offers a variety of trading instruments including forex, CFDs, and indices. Each instrument has its own unique features and benefits, so it is important to choose the right one for your trading strategy.

For example, forex pairs are often more volatile than other instruments, so they may be more suited for short-term trading strategies. Indices, on the other hand, tend to be more stable and therefore may be better suited for longer-term strategies. Ultimately, it is up to the individual trader to decide which instrument is best for their needs.

Here’s a comprehensive list of all asset classes that are available for trading at HotForex:

Forex/Currencies

HotForex offers a variety of forex currency pairs for trading, including major pairs like EUR/USD and GBP/USD, as well as more exotic pairs like USD/SGD and AUD/NZD. You can view the full list of forex currency pairs available on HotForex’s website. Spreads start at 1.3 pips for the EUR/USD pair and vary according to market conditions and the currency pairs traded.

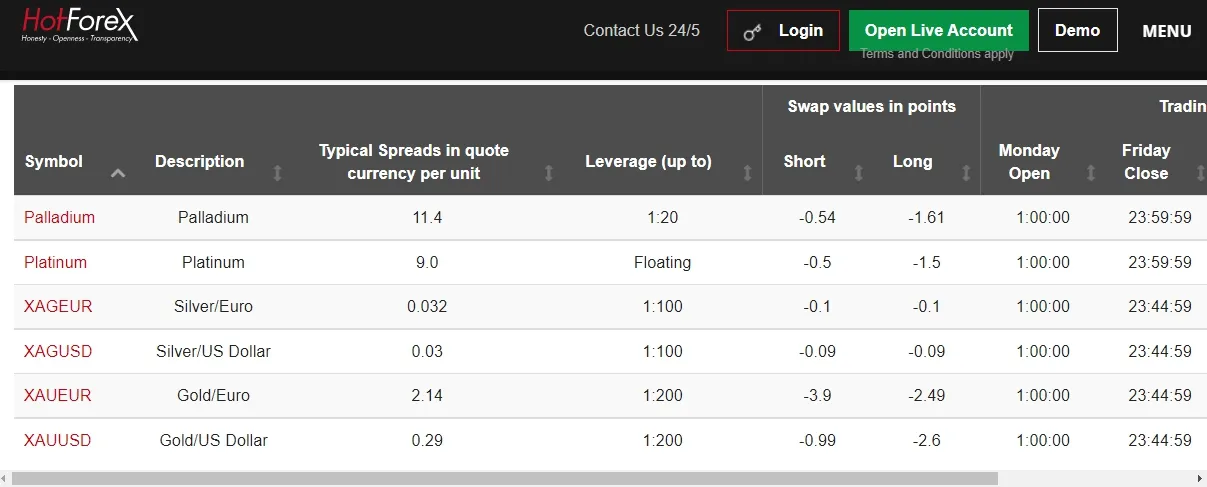

Spot Metals

Derivatives on Spot Metals Available for Trading on HotForex Kenya

HotForex offers a variety of spot metals that can be traded on its platform, including gold, silver, platinum, and palladium. These precious metals are all seen as safe-haven assets and can be used to hedge against market volatility.

Gold is the most popular metal traded on HotForex, as it is often seen as a reliable store of value during times of political or economic uncertainty. Silver is also considered a valuable commodity for investors, as it has a low correlation with other asset classes and is used in many industrial applications. Platinum and palladium are two lesser-known metals that can offer significant opportunities for traders looking to invest in the precious metals market.

Because spot metals are so volatile, they can provide massive profits (or losses) in a very short amount of time. For this reason, it’s important to always use stop losses when trading them.

A stop loss is an order that gets automatically executed when the price hits a certain level, which helps to protect your investment from large losses.

Energies on HotForex

The main energies available for trading on HofForex are USOil and UKOil. Both of these energies are popular commodities, and as such, they offer a great deal of liquidity and potential profit to traders. If you’re looking to trade oil, then HotForex Kenya is definitely worth considering as your broker.

Share Derivatives

Share derivatives are contracts that derive their value from the price of company shares. There are 70 company share derivatives that you can trade on HotForex including those of top rated companies such as Netflix, Facebook, Twitter, and Tesla.

Indices

There are a number of different indices that you can trade on HotForex, such as the US30 or the S&P 500. Each index represents a basket of stocks that can be traded as a unit. When you trade an index, you are essentially betting on the direction of the entire stock market.

The most popular indices to trade on HotForex are the S&P 500, the US Tech 100, and the Dow Jones Industrial Average (US30). These indices are all composed of a basket of stocks that are representative of the broader market. They are used as benchmarks to measure the performance of particular segments or areas of the market.

Index options are a great way to get exposure to the stock market without having to pick individual stocks. When considering whether or not to invest in an index, it’s important to do your research and understand the factors that can impact the performance of the index. For example, if you’re looking at the S&P 500, you’ll want to pay attention to economic indicators like GDP growth, inflation, and unemployment levels.

Does HotForex trade Nasdaq?

Yes. You can trade Nasdaq on HotForex. It is available as US Tech 100 with the symbol US100.F. The US Tech 100 is an index of the top 100 technology companies in the United States as determined by their market capitalization.

Bond CFDs

HotForex offers trading of bond CFDs. HotForex provides access to the Euro Bund, UK Gilt, and US 10-year Treasury Note markets. These products may be traded as a buy or sell contract.

Bond CFDs provide investors with exposure to the price movements of government and corporate bonds without having to purchase the underlying bond. This can be advantageous, as it allows investors to speculate on the direction of the bond market without having to hold the actual security.

Bond CFDs offer traders a high degree of leverage, which can magnify profits (or losses). For example, a trader who purchases a $100,000 bond CFD on HotForex with a leverage of 1:50 will only need to deposit a fraction of that amount as margin collateral.

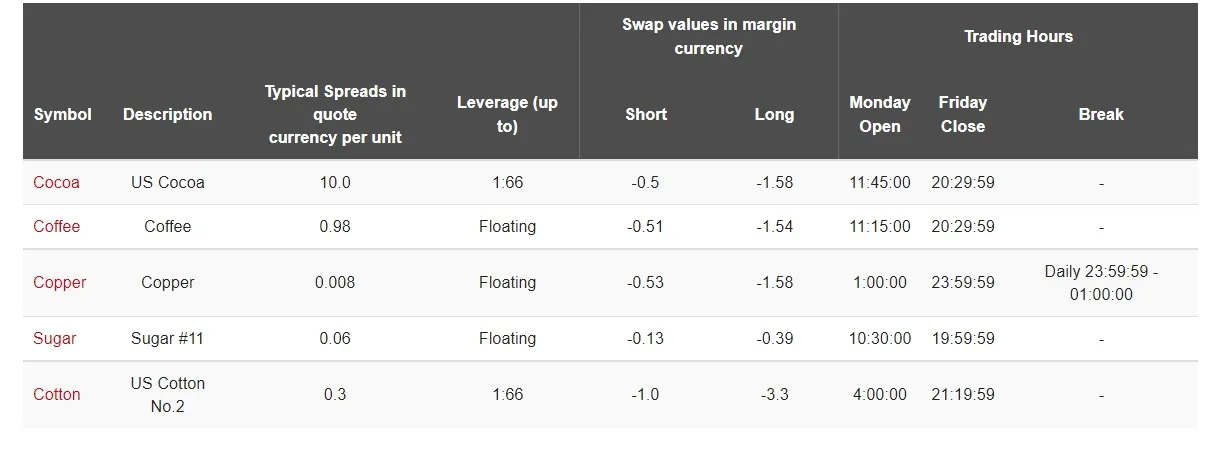

Commodities

HotForex also offers trading in a range of commodities including copper, sugar, coffee and cocoa. All of these commodities are traded as CFDs, which allows you to take a position on the price movements of the underlying asset without actually owning the asset itself.

You can trade commodity CFDs with leverage of up to 1:66, which means that you only need to deposit a small percentage of the total value of your trade in order to open a position.

Trading DMA Stocks on HotForex

DMA stocks CFDs are a type of financial derivative that allows traders to speculate on the price movements of underlying assets without actually owning the asset itself. DMA stands for direct market access, which means that when you trade a DMA stock CFD you’re directly connected to the order book of the underlying exchange. This provides you with greater transparency and better prices than if you were to trade through a traditional broker.

Trading EFTs Derivatives on HotForex

EFTs are exchange-traded funds, which are a type of investment product that tracks a basket of securities. These can include stocks, bonds, commodities, or even a mix of different asset types. ETFs trade on stock exchanges and can be bought and sold just like individual stocks.

CFDs on EFTs are a type of CFD that allows you to trade the price movements of EFTs without having to actually purchase the underlying assets. This can be advantageous for traders who want to speculate on the movement of an EFT without needing to own it.

Related Articles

Table of Contents

Stay Updated

Get the latest affiliate marketing tips and strategies delivered to your inbox.